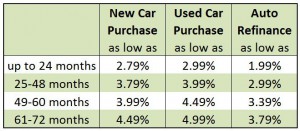

The charts below show our available loan types and terms, and the Annual Percentage Rate (APR) for each. Lock in rates for 30 days for new car loans, used car loans, or auto refinancing. Here, you can view car loan rates at 36 month, 48 or 60 month and 72 month terms. ![]()

In addition to great low rates, OpenRoad offers a variety of term options as well as other opportunities including:

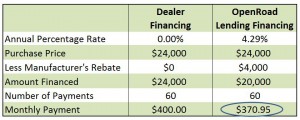

Here is a hypothetical example of a loan with the dealer at 0% APR vs choosing to take the rebate as part of your down payment and financing your new car with OpenRoad Lending:

As you can see, a combination of a loan with OpenRoad Lending and a manufactures rebate may be your best option.

Do you have questions? Please contact one of our Loan Care Agents toll-free at (888) 536-3024.

Ready to get started? Just click on the Apply Now and Save button below and you are on your way!