Let OpenRoad Lending help you get into the new car or truck you deserve. Love the smell of a new car? Let OpenRoad help you with a new car loan! With the OpenRoad eCheck® you can be in control of your car purchase options. If approved, use theOpenRoad eCheck® at any Franchised Dealer within your state of residence. Write the eCheck for any amount up to your approval amount *. With your OpenRoad eCheck® in hand, it is like having cash in your pocket where you can shop like a cash buyer.

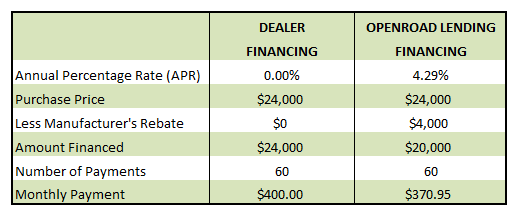

Hypothetical example of a loan with the dealer at 0% APR and choosing to use the manufacture rebate as down payment and financing your new car with OpenRoad Lending:

As you can see, a combination of a loan with OpenRoad Lending and a manufacturer’s rebate may be your best bet. If you want to know the price you will be paying before stepping foot into the dealership, check out the OpenRoad Lending Auto Buying Service. Browse dealer inventory and see the average price paid in you area.

Found a great used car at a Franchise dealer? Let OpenRoad Lending finance it for you provide you with the used car loan you deserve. With OpenRoad, you’ll know all the details of the loan before stepping foot in the dealership. Use the OpenRoad eCheck® to negotiate the sale price of the used vehicle as if you had cash on hand. Write the eCheck for any amount up to your approval amount*. With your OpenRoad eCheck® in hand, it is like having cash in your pocket where you can shop like a cash buyer.

Auto Loans – Finding the Right Loan to Buy a Car

Car Financing – The Best Loan For Your Situation

When Low Rate Dealer Financing Is the Wrong Choice

Maintaining a Hybrid Car

Car Financing For Any Budget

You have many different options when it comes to choosing an auto loan. It’s important to understand that you don’t have to take the car loan offered through the car dealership to afford a new or used car. In most cases, the auto loans provided by the dealership have higher interest rates than those provided by other lenders. Fully exploring all of your options is the best way to secure a good loan. You’ll probably be paying off your choice of lender for years to come. It’s important to do your research and make sure you have secured the best deal.

Auto loans are comprised of two major parts. The majority of the loan is the amount you borrowed to pay for your car. However, your loan also includes interest. The interest rate for loans varies from one lender to another and will be higher or lower depending on your credit score. Interest adds up quickly on a large sum, like that needed to buy a car. You should shop around for the lowest interest rate you can find. You also need to understand how the interest is paid. For most loans, your payments go toward the interest first before the principle is even affected.

If you’ve already secured a car loan but now feel that you could have gotten a better deal, you may be able to improve your situation by refinancing. However, refinancing auto loans isn’t always the best choice. It’s best to refinance early on, when you’re still paying off your interest and not just the principle. If you’re nearing the end of your loan, it’s often better to stick with your current payment plan. Refinancing also comes with several additional fees. Before you commit to refinancing an auto loan with a new lender, make sure the benefits will outweigh all these associated costs.

As with any major financial decision, you should always take your time and look into a variety of options for auto loans. Using the dealer’s financing is the most obvious option, but this shouldn’t be the only choice you explore. Your bank may offer you financing for your car as well. If you belong to a credit union, these institutions often have very good rates. The same banks that provide your credit cards will often provide auto financing. For most buyers, the choices for lenders are plentiful. The hard part is simply picking out the best option to fit your budget and your needs.